Corporate-Backed NNN Investment Property in Ottawa, Illinois

Property Description

Fee-Simple Real Estate | 100% Bonus Depreciation | Corporate-Backed NNN Lease

Commercial Plus, LLC is pleased to present the opportunity to acquire the fee-simple interest in a stabilized express car wash property in Ottawa, Illinois. This 1.08-acre site offers 250 feet of prime frontage, excellent visibility, and convenient access with multiple ingress/egress points. The property is secured by a 20-year absolute triple-net (NNN) lease with no landlord responsibilities and backed by a corporate guarantee from Sparkle Express Car Wash, Inc., ensuring predictable, long-term cash flow.

For investors, Ottawa combines credit-backed passive income with tax-efficient ownership, including the ability to utilize 100% bonus depreciation year one of ownership (per buyer’s tax advisor). The location benefits from strong retail co-tenancy, proximity to Interstate 80, and a resilient consumer base, making it a compelling play for investors seeking both stable income and long-term asset appreciation.

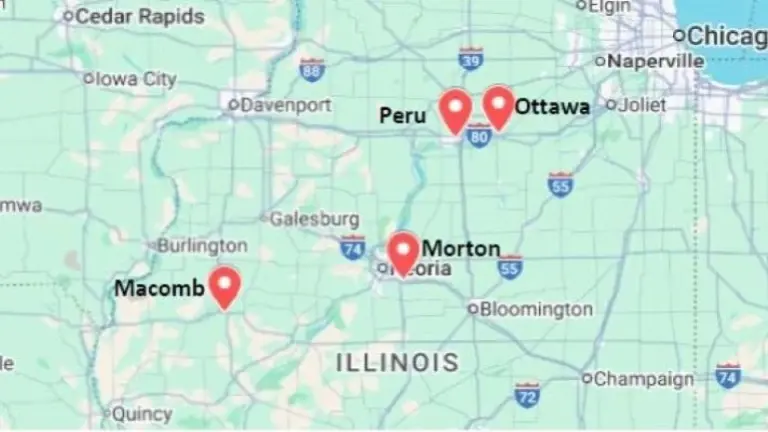

Portfolio Note - This asset is one of four Central Illinois sites (Macomb, Morton, Ottawa, Peru) available individually or as a portfolio. A portfolio acquisition offers scale, geographic diversification, and a larger corporate-backed income stream across multiple markets.

Next Steps - Please contact the listing agent to request the full Offering Memorandum, detailed lease abstracts, and materials for this site and the remaining portfolio assets

PROPERTY & OPPORTUNITY SNAPSHOT

• Lot Size: 1.08 +/- AC

• Building Size: 5,400 +/- SF

• Frontage: 250 +/- FT along Etna Road

• Traffic: 8,000+ VPD (21,600+ VPD along Columbus Street corridor)

• Lease: 20-year NNN lease through March 12, 2044

• Rent Growth: 2% annual increases

• Tenant: Sparkle Express Car Wash, Inc. (Corporate Guarantee)

• Depreciation Advantage: 100% bonus depreciation in year one of ownership

KEY INVESTMENT DRIVERS

• Corporate-Backed Income: NNN obligations guaranteed by Sparkle Express Car Wash, Inc.

• Pure Passive Income: Absolute NNN lease ensures zero landlord responsibilities

• Bonus Depreciation: 100% accelerated depreciation available in year one

• Stable Growth: 2% annual rent increases provide predictable income appreciation

• Long-Term Value: NNN income and premium appreciating infill real estate

• Portfolio Option: Available individually or within a four-site portfolio across the Central Illinois Corridor

INVESTOR HIGHLIGHTS

• Passive Income: 20-year absolute NNN lease with no landlord duties

• Tax Benefits: Accelerated depreciation maximizes first-year tax efficiency

• Corporate Credit: Backed by a strong regional operator with a corporate guarantee

• Retail Density: Walmart, Starbucks, Aldi, and more anchor the corridor

• Accessibility: Direct proximity to Interstate 80 provides regional connectivity

• Portfolio Growth: Optional aggregation with additional sites for scale and diversification

WHY INVEST IN THE CENTRAL ILLINOIS CORRIDOR?

The Central Illinois Corridor, anchored by Peoria, Ottawa, Morton, and Macomb, reaches over 513.6K people across 211.8K households, with an average household income of $92.1K+. This provides a compelling blend of stability, growth, and diversification, especially when viewed through the lens of value investing. Landlord fundamentals are reinforced by the corridor’s interstate connectivity (I-74/I-80/I-39), strong mobility (?1.85 vehicles/household), and ongoing industrial/logistics investment with blue-chip anchors (e.g., Caterpillar, OSF, Frito-Lay, Trader Joe’s, Ameren, Komatsu), which collectively support steady traffic, employment, and spend.

For investors, Ottawa combines credit-backed passive income with tax-efficient ownership, including the ability to utilize 100% bonus depreciation year one of ownership (per buyer’s tax advisor). The location benefits from strong retail co-tenancy, proximity to Interstate 80, and a resilient consumer base, making it a compelling play for investors seeking both stable income and long-term asset appreciation.

Portfolio Note - This asset is one of four Central Illinois sites (Macomb, Morton, Ottawa, Peru) available individually or as a portfolio. A portfolio acquisition offers scale, geographic diversification, and a larger corporate-backed income stream across multiple markets.

Next Steps - Please contact the listing agent to request the full Offering Memorandum, detailed lease abstracts, and materials for this site and the remaining portfolio assets

PROPERTY & OPPORTUNITY SNAPSHOT

• Lot Size: 1.08 +/- AC

• Building Size: 5,400 +/- SF

• Frontage: 250 +/- FT along Etna Road

• Traffic: 8,000+ VPD (21,600+ VPD along Columbus Street corridor)

• Lease: 20-year NNN lease through March 12, 2044

• Rent Growth: 2% annual increases

• Tenant: Sparkle Express Car Wash, Inc. (Corporate Guarantee)

• Depreciation Advantage: 100% bonus depreciation in year one of ownership

KEY INVESTMENT DRIVERS

• Corporate-Backed Income: NNN obligations guaranteed by Sparkle Express Car Wash, Inc.

• Pure Passive Income: Absolute NNN lease ensures zero landlord responsibilities

• Bonus Depreciation: 100% accelerated depreciation available in year one

• Stable Growth: 2% annual rent increases provide predictable income appreciation

• Long-Term Value: NNN income and premium appreciating infill real estate

• Portfolio Option: Available individually or within a four-site portfolio across the Central Illinois Corridor

INVESTOR HIGHLIGHTS

• Passive Income: 20-year absolute NNN lease with no landlord duties

• Tax Benefits: Accelerated depreciation maximizes first-year tax efficiency

• Corporate Credit: Backed by a strong regional operator with a corporate guarantee

• Retail Density: Walmart, Starbucks, Aldi, and more anchor the corridor

• Accessibility: Direct proximity to Interstate 80 provides regional connectivity

• Portfolio Growth: Optional aggregation with additional sites for scale and diversification

WHY INVEST IN THE CENTRAL ILLINOIS CORRIDOR?

The Central Illinois Corridor, anchored by Peoria, Ottawa, Morton, and Macomb, reaches over 513.6K people across 211.8K households, with an average household income of $92.1K+. This provides a compelling blend of stability, growth, and diversification, especially when viewed through the lens of value investing. Landlord fundamentals are reinforced by the corridor’s interstate connectivity (I-74/I-80/I-39), strong mobility (?1.85 vehicles/household), and ongoing industrial/logistics investment with blue-chip anchors (e.g., Caterpillar, OSF, Frito-Lay, Trader Joe’s, Ameren, Komatsu), which collectively support steady traffic, employment, and spend.

Listing Info

- ID:

- 2415468

- Listing Views:

- 305

Attached DocumentsAttachment Disclaimer

Business Location

Listing ID: 2415468 The information on this listing has been provided by either the seller or a business broker representing the seller. BizQuest has no interest or stake in the sale of this business and has not verified any of the information and assumes no responsibility for its accuracy, veracity, or completeness. See our full Terms of Use. Learn how to avoid scams.