Hot Listing

High Precision CNC Machining Company

Business Description

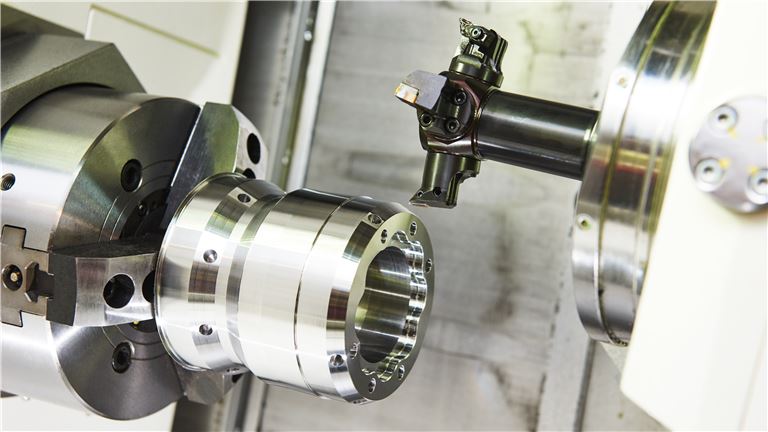

Business Summary: NEO Business Advisors represents a well-established, high precision CNC machining business in Northeast Ohio with an almost 70-year history. The business has state-of-the-art CNC machining centers, many with live tooling, 5-axis capabilities, pallet changers, and dedicated tooling at each machine. The company is uniquely positioned with specialty in-house fabrication capabilities that give them a defensible, high-margin position in the end-market industries they serve with their #1 customer who is approximately 55% of sales with a 50+ year history. The second largest customer is an OEM who accounts for about 35% of sales with a 20+ year history and is sole source with the company for machined parts. The balance 10% of revenue is made up of another 8-10 customers each year. The husband-and-wife owners are active in the business full time and 5-10 hours per week respectively. A seasoned and cross-trained team, led by a skilled shop superintendent and veteran quality manager, allows the owners to manage operations semi-absentee and travel extensively. This rare opportunity will not last long with a consistent history of over 35% Adjusted EBITDA Margins. This is an excellent opportunity for an individual buyer looking to acquire a business with high profit margins, extensive capabilities, strong management team, excellent reputation, and defensible market position. The business is also an excellent strategic acquisition for an established company in the same or adjacent industry looking to grow their market share, expand their geographic reach, add capabilities, diversify customers and end markets, or acquire highly skilled personnel.

Financial Overview:

Revenue by Year:

Pro 2025 - $7,698,998

2024 - $7,359,058

2023 - $7,384,448

Adjusted EBITDA by Year:

Pro 2025 - $2,993,077 (38.88%)

2024 - $2,703,341 (36.73%)

2023 - $2,596,008 (35.16%)

3 Year Weighted Average Adjusted EBITDA - $2,830,320

Furniture, Fixtures, and Equipment (FF&E): FF&E of $3,885,000 is included in the asking price including a significant asset base of high-precision CNC machining centers including lathes, vertical mills, horizontal mills, EDM, grinders, saws and specialty fabrication capabilities. Equipment is all well maintained with several new machines added each of the last few years. The company has an extensive inventory of tooling, fixtures, and support equipment along with pallet racking and shelving for storage and two company owned trucks for local pickups and deliveries. The office and shop are fully computerized with an enterprise resource planning (ERP) software system managing the production environment.

Working Capital: Inventory, Accounts Receivable, and Accounts Payable are included in the asking price as part of a normal level of Working Capital of $3,600,000 with the final sale price to be adjusted up or down for actual amount of Working Capital at time of closing.

Real Estate: Real Estate is owned by the Company and available for sale or lease with the business. Estimated value is $1,500,000 not included in the Asking Price of the business. The building is approximately 25,000 SF of manufacturing and office space with three overhead cranes and over a dozen jib and pedestal cranes.

Growth and Expansion: The owner does not currently do any outbound sales and marketing and relies entirely on repeat business from existing customers with whom they are turning work down because of capacity constraints. Investing in people would be the best way to continue to grow the business because the opportunities for more work are already there. Sales and marketing efforts could be implemented to diversify the customer concentration if a buyer felt this was a risk factor.

Reason for Selling: The owner is seeking a sale for retirement.

Support & Training: The owner is willing to stay on for up to two years after a sale to ensure a smooth transition of ownership.

Financial Overview:

Revenue by Year:

Pro 2025 - $7,698,998

2024 - $7,359,058

2023 - $7,384,448

Adjusted EBITDA by Year:

Pro 2025 - $2,993,077 (38.88%)

2024 - $2,703,341 (36.73%)

2023 - $2,596,008 (35.16%)

3 Year Weighted Average Adjusted EBITDA - $2,830,320

Furniture, Fixtures, and Equipment (FF&E): FF&E of $3,885,000 is included in the asking price including a significant asset base of high-precision CNC machining centers including lathes, vertical mills, horizontal mills, EDM, grinders, saws and specialty fabrication capabilities. Equipment is all well maintained with several new machines added each of the last few years. The company has an extensive inventory of tooling, fixtures, and support equipment along with pallet racking and shelving for storage and two company owned trucks for local pickups and deliveries. The office and shop are fully computerized with an enterprise resource planning (ERP) software system managing the production environment.

Working Capital: Inventory, Accounts Receivable, and Accounts Payable are included in the asking price as part of a normal level of Working Capital of $3,600,000 with the final sale price to be adjusted up or down for actual amount of Working Capital at time of closing.

Real Estate: Real Estate is owned by the Company and available for sale or lease with the business. Estimated value is $1,500,000 not included in the Asking Price of the business. The building is approximately 25,000 SF of manufacturing and office space with three overhead cranes and over a dozen jib and pedestal cranes.

Growth and Expansion: The owner does not currently do any outbound sales and marketing and relies entirely on repeat business from existing customers with whom they are turning work down because of capacity constraints. Investing in people would be the best way to continue to grow the business because the opportunities for more work are already there. Sales and marketing efforts could be implemented to diversify the customer concentration if a buyer felt this was a risk factor.

Reason for Selling: The owner is seeking a sale for retirement.

Support & Training: The owner is willing to stay on for up to two years after a sale to ensure a smooth transition of ownership.

About the Business

- Years in Operation

- 70

- Employees

- 28

Real Estate

- Owned or Leased

- Owned

- Not included in asking price

- Building Sq. Ft.

- 25,000

Listing Info

- ID

- 2314595

- Listing Views

- 9986

Listing ID: 2314595 The information on this listing has been provided by either the seller or a business broker representing the seller. BizQuest has no interest or stake in the sale of this business and has not verified any of the information and assumes no responsibility for its accuracy, veracity, or completeness. See our full Terms of Use. Learn how to avoid scams.

Businesses for SaleOhio Businesses for SaleOhio Manufacturing Businesses for SaleOhio Other Manufacturing Businesses for Sale