High-Margin Industrial Equipment Manufacturer | 70%+ GM | No Debt

Business Description

$1.30M+ Avg SDE | 26 Years | Global Installed Base

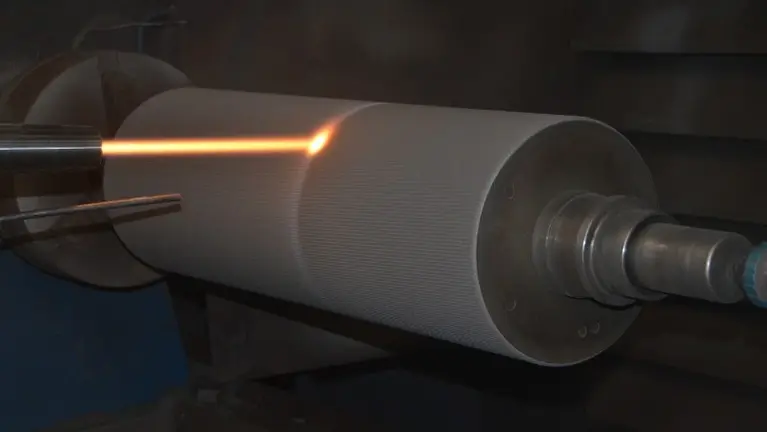

Established U.S.-based designer and manufacturer of advanced HVAF (High Velocity Air Fuel) thermal spray systems and precision industrial powder feeders. Founded in 1999 by the inventor of modern HVAF combustion technology, the Company is widely recognized as the originator of contemporary HVAF spray system design.

Over 26 years, the business has built a global installed base of 165+ HVAF systems and approximately 400 powder feeders across more than 45 countries. Roughly 60–70% of annual revenue comes from repeat customers purchasing spare parts, additional feeders, system upgrades, and related services.

Financial Highlights (Cash Basis)

• 4-Year Average Revenue: ~$2.47M

• 3-Year Average SDE (2023–2025): ~$1.30M

• 4-Year Average SDE: ~$1.38M

• 4-Year Average Gross Margin: ~71%

• No debt

• Lean 5-person team

The Company operates with minimal capital expenditure requirements and a highly efficient assembly-focused model. Gross margins have consistently ranged from the mid-60s to high-70s, producing strong discretionary earnings and meaningful operating leverage.

Products & Technology

The product portfolio includes:

• Flagship HVAF thermal spray systems (typical pricing $120K–$200K+)

• Internal diameter HVAF guns

• Ultra-thin tungsten carbide coatings that serve as a direct alternative to hard chrome plating

• Gravimetric and volumetric powder feeders compatible with HVAF, HVOF, plasma, cold spray, and laser cladding

Two active U.S. patents protect core powder feeder mechanisms (expiring 2035 & 2037). The business maintains a full proprietary software suite and complete 3D CAD engineering library. All systems are designed in-house and assembled onsite using outsourced precision machining partners, minimizing capital intensity.

Revenue Mix (Representative Year)

• Equipment – Powder Feeders (~47%)

• Equipment – HVAF Systems (~16%)

• Spare Parts (~20%)

• Coating Applications & Services (~17%)

Approximately 50% of revenue is generated through an established international distributor network, with the balance from direct global sales. No single customer accounts for more than ~15% of revenue.

Market Position

HVAF technology is increasingly replacing traditional HVOF processes due to superior coating density, higher deposition rates, lower operating costs, and regulatory pressure on hexavalent chromium (Cr6+) hard chrome plating. As specifications evolve to accept HVAF, adoption is accelerating worldwide.

Competitive strengths include:

• 25+ years of proprietary HVAF system and precision powder feeder design expertise

• Strong technical barriers to entry

• Embedded global installed base

• Process-agnostic powder feeder platform

Facility

Operations are conducted from a purpose-built 6,000 SF industrial facility on 2.2 acres (M-2 zoning) with expansion capacity to 15,000 SF. Real estate is available separately at appraised value.

Growth Opportunities

The Company has operated without a dedicated sales team, relying primarily on inbound demand and distributors. Key expansion levers include:

• Hiring dedicated sales/business development

• Expanding powder feeder market share across non-HVAF processes

• Geographic expansion into underpenetrated regions

• Scaling coating services

• Strategic add-on acquisitions for platform buyers

Asking Price: $4,950,000 (Business Only)

Optional Real Estate Available ($1,375,000 Appraised)

Owners are seeking retirement and will provide transition support.

Over 26 years, the business has built a global installed base of 165+ HVAF systems and approximately 400 powder feeders across more than 45 countries. Roughly 60–70% of annual revenue comes from repeat customers purchasing spare parts, additional feeders, system upgrades, and related services.

Financial Highlights (Cash Basis)

• 4-Year Average Revenue: ~$2.47M

• 3-Year Average SDE (2023–2025): ~$1.30M

• 4-Year Average SDE: ~$1.38M

• 4-Year Average Gross Margin: ~71%

• No debt

• Lean 5-person team

The Company operates with minimal capital expenditure requirements and a highly efficient assembly-focused model. Gross margins have consistently ranged from the mid-60s to high-70s, producing strong discretionary earnings and meaningful operating leverage.

Products & Technology

The product portfolio includes:

• Flagship HVAF thermal spray systems (typical pricing $120K–$200K+)

• Internal diameter HVAF guns

• Ultra-thin tungsten carbide coatings that serve as a direct alternative to hard chrome plating

• Gravimetric and volumetric powder feeders compatible with HVAF, HVOF, plasma, cold spray, and laser cladding

Two active U.S. patents protect core powder feeder mechanisms (expiring 2035 & 2037). The business maintains a full proprietary software suite and complete 3D CAD engineering library. All systems are designed in-house and assembled onsite using outsourced precision machining partners, minimizing capital intensity.

Revenue Mix (Representative Year)

• Equipment – Powder Feeders (~47%)

• Equipment – HVAF Systems (~16%)

• Spare Parts (~20%)

• Coating Applications & Services (~17%)

Approximately 50% of revenue is generated through an established international distributor network, with the balance from direct global sales. No single customer accounts for more than ~15% of revenue.

Market Position

HVAF technology is increasingly replacing traditional HVOF processes due to superior coating density, higher deposition rates, lower operating costs, and regulatory pressure on hexavalent chromium (Cr6+) hard chrome plating. As specifications evolve to accept HVAF, adoption is accelerating worldwide.

Competitive strengths include:

• 25+ years of proprietary HVAF system and precision powder feeder design expertise

• Strong technical barriers to entry

• Embedded global installed base

• Process-agnostic powder feeder platform

Facility

Operations are conducted from a purpose-built 6,000 SF industrial facility on 2.2 acres (M-2 zoning) with expansion capacity to 15,000 SF. Real estate is available separately at appraised value.

Growth Opportunities

The Company has operated without a dedicated sales team, relying primarily on inbound demand and distributors. Key expansion levers include:

• Hiring dedicated sales/business development

• Expanding powder feeder market share across non-HVAF processes

• Geographic expansion into underpenetrated regions

• Scaling coating services

• Strategic add-on acquisitions for platform buyers

Asking Price: $4,950,000 (Business Only)

Optional Real Estate Available ($1,375,000 Appraised)

Owners are seeking retirement and will provide transition support.

About the Business

- Years in Operation

- 27

- Employees

- 5 Full-time

3 owners, 2 employees - Facilities & Assets

- Operations are conducted from a 6,000 SF purpose-built industrial facility on 2.2 acres (M-2 zoning). The building includes warehouse, office, and assembly space, with two equipped spray cells, ventilation systems, robotic manipulator, overhead crane, and dedicated thermal spray infrastructure. Estimated equipment replacement cost is approximately $1.0M. Pre-approved expansion supports growth to 15,000 SF. Real estate available separately.

- Market Outlook / Competition

- The Company serves a niche segment of the global thermal spray market centered on advanced HVAF systems. Direct competitors are limited, and barriers to entry are largely technological, requiring decades of combustion engineering expertise, process control integration, and accumulated R&D refinement. A substantial installed base and established distribution relationships further reinforce competitive positioning.

- Opportunities for Growth

- HVAF adoption is accelerating as customers transition from legacy HVOF processes, creating ongoing replacement demand. The Company’s powder feeder technology addresses a broader global market beyond thermal spray, serving multiple precision manufacturing applications requiring controlled powder flow. With no dedicated sales team and primarily inbound demand, significant upside exists through proactive commercial expansion.

Real Estate

- Owned or Leased

- Owned

- Not included in asking price

- Building Sq. Ft.

- 6,000

About the Sale

- Seller Motivation

- Owners pursuing retirement after 25+ years of continuous operation.

- Transition Support

- Seller will provide up to 3 months of transition support to ensure continuity of operations, including customer introductions, supplier relationships, engineering handoff, and process training. Additional consulting support may be available under a mutually agreed arrangement.

- Financing Options

- Seller will consider SBA-compliant standby note solely if required.

Listing Info

- ID

- 2472503

- Listing Views

Listing ID: 2472503 The information on this listing has been provided by either the seller or a business broker representing the seller. BizQuest has no interest or stake in the sale of this business and has not verified any of the information and assumes no responsibility for its accuracy, veracity, or completeness. See our full Terms of Use. Learn how to avoid scams.

Businesses for Sale Manufacturing Businesses for Sale Industrial Machinery Manufacturing Businesses for Sale