Hot Listing

20 year old fully remote Software as a Service (SaaS) company

Business Description

Software Company Acquisition Opportunity

Merger Solution has been exclusively retained to sell a U.S.-based, fully remote software firm with over 20 years of proven success is offering a turnkey acquisition opportunity in the thriving kitchen & bath technology sector. The business brings a highly specialized, recurring-revenue model and deep domain expertise, serving manufacturers, dealers, and designers across North America.

With a stable customer base and robust industry reputation, the company’s platform powers mission-critical workflow automation, connecting product data, configuration, quoting, and ordering from the initial designer interaction to production-ready fulfillment. Its modular solutions and API integrations are trusted by thousands of users and major industry partners, enabling seamless connectivity between CAD, ERP, and commerce systems.

Key attributes include:

• Recurring revenue exceeding 90% of total revenue of $1.5 million from multi-year SaaS contracts with consistent year-over-year growth.

• Industry leader status in electronic catalog solutions, configuration, and quoting for complex products.

• Strong operational leverage with scalable cloud-based infrastructure; no brick-and-mortar liabilities.

• Fully remote team of seasoned professionals poised for post-transaction continuity.

• Opportunity to unlock significant untapped market share (~6,000 U.S. manufacturers) and accelerate adoption of recently launched innovations.

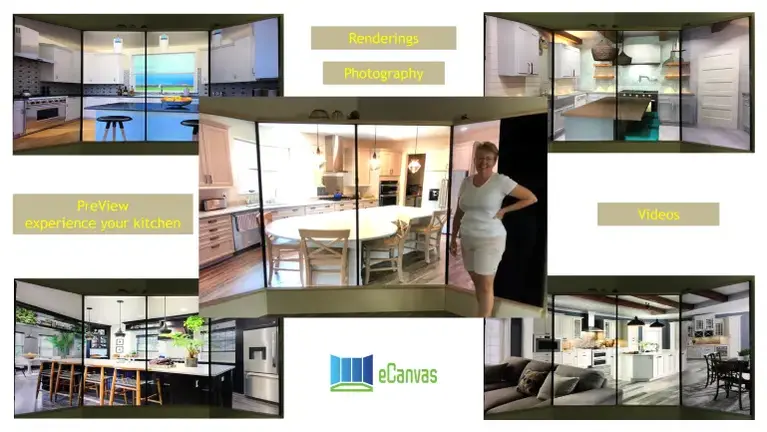

• Robust product pipeline, including immersive visualization and spec management tools with immediate cross-sell access to a large installed customer base.

• Founder-led succession plan ensures smooth transition, with leadership willing to remain onboard for continuity.

Target buyers are those seeking an established entry into SaaS for built-environment verticals, with powerful embedded workflow solutions and growth runway supported by transformative technology, proven processes, and a loyal client ecosystem.

Merger Solution has been exclusively retained to sell a U.S.-based, fully remote software firm with over 20 years of proven success is offering a turnkey acquisition opportunity in the thriving kitchen & bath technology sector. The business brings a highly specialized, recurring-revenue model and deep domain expertise, serving manufacturers, dealers, and designers across North America.

With a stable customer base and robust industry reputation, the company’s platform powers mission-critical workflow automation, connecting product data, configuration, quoting, and ordering from the initial designer interaction to production-ready fulfillment. Its modular solutions and API integrations are trusted by thousands of users and major industry partners, enabling seamless connectivity between CAD, ERP, and commerce systems.

Key attributes include:

• Recurring revenue exceeding 90% of total revenue of $1.5 million from multi-year SaaS contracts with consistent year-over-year growth.

• Industry leader status in electronic catalog solutions, configuration, and quoting for complex products.

• Strong operational leverage with scalable cloud-based infrastructure; no brick-and-mortar liabilities.

• Fully remote team of seasoned professionals poised for post-transaction continuity.

• Opportunity to unlock significant untapped market share (~6,000 U.S. manufacturers) and accelerate adoption of recently launched innovations.

• Robust product pipeline, including immersive visualization and spec management tools with immediate cross-sell access to a large installed customer base.

• Founder-led succession plan ensures smooth transition, with leadership willing to remain onboard for continuity.

Target buyers are those seeking an established entry into SaaS for built-environment verticals, with powerful embedded workflow solutions and growth runway supported by transformative technology, proven processes, and a loyal client ecosystem.

About the Business

- Years in Operation

- 21

- Employees

- 11 (10 Full-time, 1 Part-time)

- Currently Relocatable

- Yes

- Currently Home Based

- Yes

- Facilities & Assets

- All employees work remotely. Assets consist of computers and software.

- Market Outlook / Competition

- Market conditions are excellent, and competition is minimal.

- Opportunities for Growth

- Growth in SaaS, and in this product in particular, is strong. In addition to the primary products, the company has new products yet to be marketed. A buyer with strong sales and marketing experience can significantly grow this company.

About the Sale

- Seller Motivation

- Retirment of the majority shareholder who is the business manager.

- Transition Support

- All software developers and programmers remain with the business and can train the new owner as needed. The new owner would ideally bring sales and marketing expertise.

Listing Info

- ID

- 2465593

- Listing Views

- 69

Attached DocumentsAttachment Disclaimer

Listing ID: 2465593 The information on this listing has been provided by either the seller or a business broker representing the seller. BizQuest has no interest or stake in the sale of this business and has not verified any of the information and assumes no responsibility for its accuracy, veracity, or completeness. See our full Terms of Use. Learn how to avoid scams.